Production Costs

Production costs refer to the expenses incurred by a company during the manufacturing process of its products or services. It includes the cost of raw materials, labor, equipment, and other resources used in the production process. Understanding production costs is essential for businesses to effectively manage their expenses, optimize productivity, and make informed pricing decisions. Let’s take a closer look at the key factors and considerations related to production costs.

Key Takeaways

- Production costs encompass raw materials, labor, equipment, and resources used in the manufacturing process.

- Understanding production costs helps businesses optimize productivity and make informed pricing decisions.

**Raw materials** are a significant component of production costs.*** Efficiently sourcing and managing raw materials is crucial for cost control and maintaining product quality. Businesses often establish relationships with suppliers to secure favorable pricing and ensure a steady supply of materials.

**Labor costs** can vary significantly depending on the industry, location, and skill level required for the production process.*** Automating certain tasks can help reduce labor costs, increase efficiency, and minimize errors. However, it’s important to strike a balance between automation and maintaining human expertise, particularly in industries where precision and customization are essential.

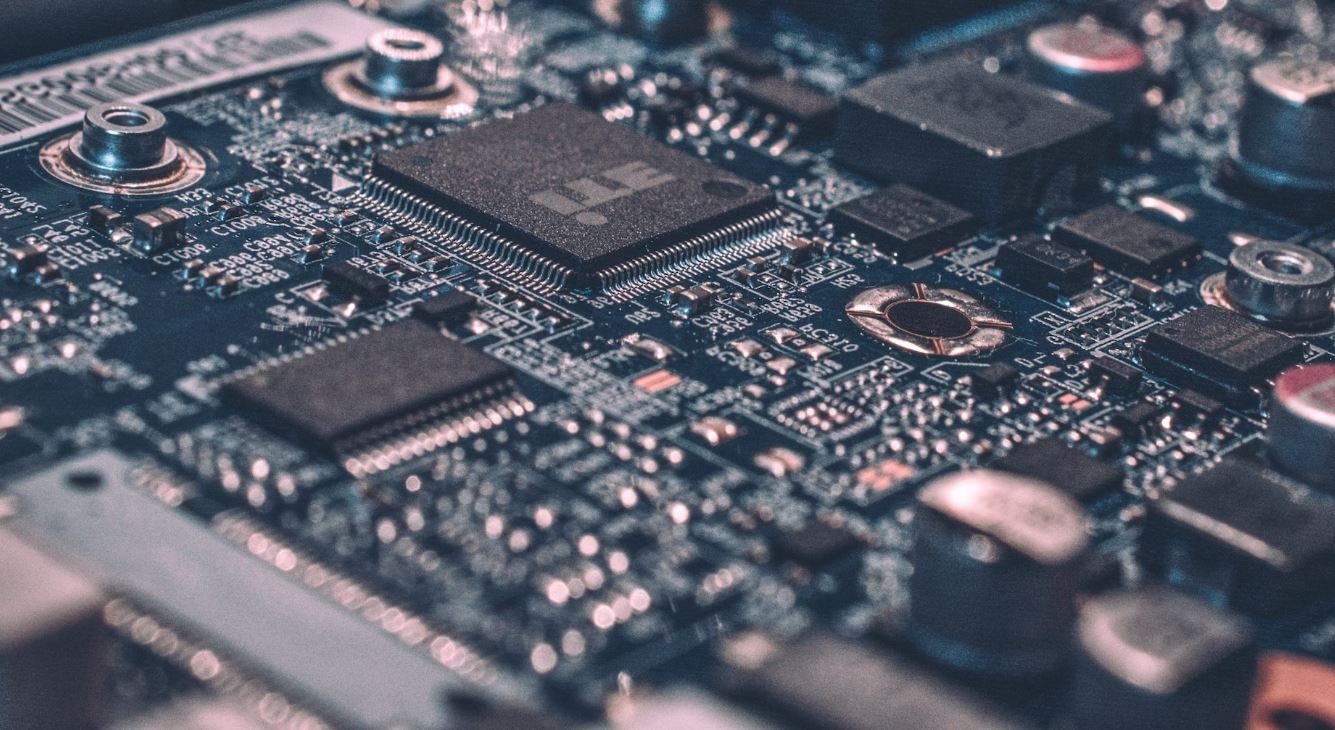

**Equipment expenses** include the purchase, maintenance, and operation of machinery and tools used in production.*** Investing in modern, efficient equipment can improve productivity, reduce downtime, and lower long-term costs. Regular maintenance and upgrades ensure that equipment operates optimally and minimizes the risk of breakdowns.

Production Cost Components

Production costs can be further divided into three major components:

- Fixed costs: These costs remain constant regardless of the level of production. They include expenses such as rent, utilities, insurance, and salaries for management and administrative staff.

- Variable costs: These costs fluctuate based on the volume of production. They include expenses like raw materials, direct labor, and packaging materials. The cost per unit decreases with higher production levels due to economies of scale.

- Semi-variable costs: These costs have both fixed and variable components. Examples include utilities that increase with production but have a minimum fixed cost.

Each component contributes differently to the overall production costs, and understanding their dynamics can help businesses make informed decisions to optimize their operations.

Production Cost Analysis

Performing a detailed **production cost analysis** provides businesses with valuable insights into their expenses and profitability. It involves:

- Accurately tracking all costs associated with production, including direct and indirect expenses.

- Identifying cost drivers, such as labor-intensive processes or raw material price fluctuations.

- Comparing production costs over time to identify trends and potential areas for improvement.

An ongoing production cost analysis enables businesses to proactively manage expenses, identify cost-saving opportunities, and remain competitive in the market.

Factors Influencing Production Costs

Several factors influence production costs. Here are some of the key factors to consider:

- **Economies of scale:** Producing in higher volumes often leads to lower production costs per unit due to bulk purchasing power and increased efficiency.

- **Technology advancements:** Adopting new technologies can streamline production processes, reduce waste, and lower costs.

- **Resource availability:** Fluctuations in the availability and cost of raw materials and energy sources can significantly impact production costs.

- **Labor market conditions:** Employing skilled workers may come at a higher cost, particularly in competitive industries with a shortage of qualified professionals.

- **Geographical location:** Production costs can vary based on regional factors such as taxes, regulations, transportation expenses, and proximity to suppliers or customers.

Production Cost Optimization

Maximizing productivity and cost efficiency is a continuous endeavor for businesses. Here are some strategies to optimize production costs:

- Implement lean manufacturing principles to eliminate waste and streamline processes.

- Regularly review supplier relationships and negotiate favorable terms for raw material procurement.

- Invest in employee training and development to enhance skills and productivity.

- Adopt sustainable practices to minimize waste and reduce environmental costs.

- Continuously monitor and analyze production costs to identify areas for improvement.

Data Tables

| Year | Total Production Costs (in millions) |

|---|---|

| 2018 | 500 |

| 2019 | 550 |

| 2020 | 600 |

The table above shows the total production costs for a company over a three-year period. It indicates a steady increase in production costs, highlighting the importance of cost management and optimization.

| Production Component | % of Total Production Costs |

|---|---|

| Raw Materials | 40% |

| Labor Costs | 30% |

| Equipment Expenses | 20% |

| Other Costs | 10% |

The table above shows the distribution of production costs among different components based on their percentage contribution. It helps businesses identify areas where cost reduction efforts may be most effective.

| Production Volume | Average Production Cost per Unit |

|---|---|

| 100 units | $10 |

| 500 units | $8 |

| 1000 units | $7 |

The table above illustrates the effect of production volume on the average production cost per unit. As the volume increases, the per-unit cost decreases due to economies of scale.

Understanding and managing production costs is crucial for businesses striving to maintain profitability and competitiveness. By analyzing cost components, identifying influencing factors, and implementing optimization strategies, companies can effectively control expenses and achieve sustainable growth.

Common Misconceptions

Paragraph 1: One common misconception people have about production costs is that they are solely dependent on the price of raw materials. While the cost of materials is indeed a significant factor, there are several other factors that contribute to overall production costs.

- Availability of skilled labor

- Energy costs

- Transportation expenses

Paragraph 2: Another misconception is that production costs can be significantly reduced by outsourcing production to low-wage countries. While labor costs may be lower in certain regions, there are often additional expenses and challenges that must be considered.

- Import and export duties

- Language and cultural barriers

- Quality control issues

Paragraph 3: Some people mistakenly believe that increasing production volume will always lead to lower production costs due to economies of scale. While this is often true, there are instances where certain costs may actually increase as production volume increases.

- Cost of additional machinery or equipment

- Higher energy consumption

- Inefficiencies in production processes

Paragraph 4: Many people underestimate the impact that technological advancements can have on production costs. Some believe that outdated technology and machinery are sufficient, but this can lead to higher costs in the long run.

- Maintenance and repair expenses for old machinery

- Inefficiencies caused by outdated technology

- Opportunity costs of not adopting more efficient methods

Paragraph 5: Lastly, there is a common misconception that production costs are solely the responsibility of the production department. In reality, factors such as marketing, administration, and research and development also play a significant role in determining overall production costs.

- Marketing expenses to promote the product

- Administrative costs related to managing production operations

- Research and development costs for improving production processes

Production Costs

Production costs are a crucial factor that businesses consider when determining their profitability and pricing strategies. In this article, we will explore various aspects of production costs, including labor costs, raw material expenses, and overhead expenses.

1. Labor Costs by Country

The following table showcases the average hourly labor costs in different countries. These costs are essential for businesses considering outsourcing or setting up production facilities in various locations.

| Country | Average Hourly Labor Cost (USD) |

|---|---|

| United States | 25 |

| China | 5 |

| Germany | 35 |

| India | 3 |

2. Raw Material Expenses

This table provides insights into the costs of various raw materials commonly used in production processes. It highlights the current market prices and helps businesses make informed decisions regarding sourcing and inventory management.

| Material | Price per Unit (USD) |

|---|---|

| Steel | 0.80 |

| Aluminum | 1.20 |

| Cotton | 0.50 |

| Plastic | 0.30 |

3. Overhead Expenses Breakdown

This table presents a breakdown of overhead expenses typically incurred by businesses during production. It helps quantify the indirect costs associated with operations and provides a basis for analyzing and optimizing these expenses.

| Expense Type | Percentage of Total Overhead Costs |

|---|---|

| Rent | 25% |

| Utilities | 15% |

| Insurance | 10% |

| Maintenance | 5% |

4. Average Productivity by Industry

In order to assess production costs effectively, businesses often measure average productivity. This table presents the average output per employee for various industries, allowing companies to benchmark their own productivity levels.

| Industry | Average Output per Employee (units) |

|---|---|

| Automotive | 250 |

| Pharmaceuticals | 350 |

| Textiles | 150 |

| Electronics | 450 |

5. Energy Costs Comparison

Energy costs play a significant role in production expenses. This table compares the average energy costs (per kilowatt-hour) for different energy sources, helping businesses evaluate the most cost-effective and sustainable options.

| Energy Source | Cost per Kilowatt-hour (USD) |

|---|---|

| Coal | 0.05 |

| Natural Gas | 0.03 |

| Solar | 0.08 |

| Wind | 0.06 |

6. Total Cost of Waste

Waste management is an integral part of production processes. This table showcases the total cost associated with waste generation and disposal, helping companies identify areas for improvement and cost reduction.

| Waste Type | Total Cost (USD) |

|---|---|

| Scrap Material | 10,000 |

| Wastewater Treatment | 5,000 |

| Landfill Disposal | 2,000 |

| Recycling | 3,000 |

7. Supply Chain Costs

Supply chain management encompasses several stages and costs. This table breaks down the different costs involved in the overall supply chain process, aiding businesses in optimizing their supply chain strategies.

| Cost Type | Percentage of Total Supply Chain Costs |

|---|---|

| Transportation | 30% |

| Warehousing | 25% |

| Inventory Holding | 20% |

| Order Processing | 15% |

8. Cost of Quality

Poor quality can lead to significant financial losses. This table demonstrates the cost of quality, including inspection, rework, and warranty claims, enabling businesses to assess the benefits of investing in quality control measures.

| Quality Cost Component | Percentage of Total Production Costs |

|---|---|

| Inspection | 2% |

| Rework | 5% |

| Warranty Claims | 3% |

| Testing | 1% |

9. Cost Reduction Initiatives

This table presents various cost reduction initiatives implemented by businesses to decrease production costs. These strategies help streamline operations and improve profitability in highly competitive markets.

| Initiative | Resulting Cost Savings (USD) |

|---|---|

| Lean Manufacturing | 500,000 |

| Automation | 1,000,000 |

| Sourcing Optimization | 750,000 |

| Process Improvement | 250,000 |

10. Cost Breakdown by Product

This table provides a breakdown of production costs by product. It allows businesses to identify the most and least cost-intensive products, aiding in strategic decision-making and pricing.

| Product Name | Total Production Cost (USD) |

|---|---|

| Product A | 100,000 |

| Product B | 50,000 |

| Product C | 75,000 |

| Product D | 125,000 |

In conclusion, production costs encompass various elements such as labor, raw materials, overheads, energy, waste, supply chain, quality, and cost reduction initiatives. Understanding and effectively managing these costs is essential for businesses to remain competitive and maximize profitability.